Key Health Policy Actions to Watch for the Rest of 2025

Summary

Policy initiatives announced in early 2025 are now at an inflection point as they converge with regulatory cycles and are set to drive significant activity.The first eight months of the Trump administration featured a steady stream of announcements and initiatives related to competition, prescription drug prices, and the broader healthcare marketplace. These included signals around international reference pricing, scrutiny of pharmacy benefit managers (PBMs) and rebates, and rhetoric around reshoring and manufacturing incentives.

While these developments underscored the administration’s priorities, they created uncertainty that impacted business planning, pricing, and investment strategies. Many efforts stopped short of immediate policy change, keeping stakeholders on edge.

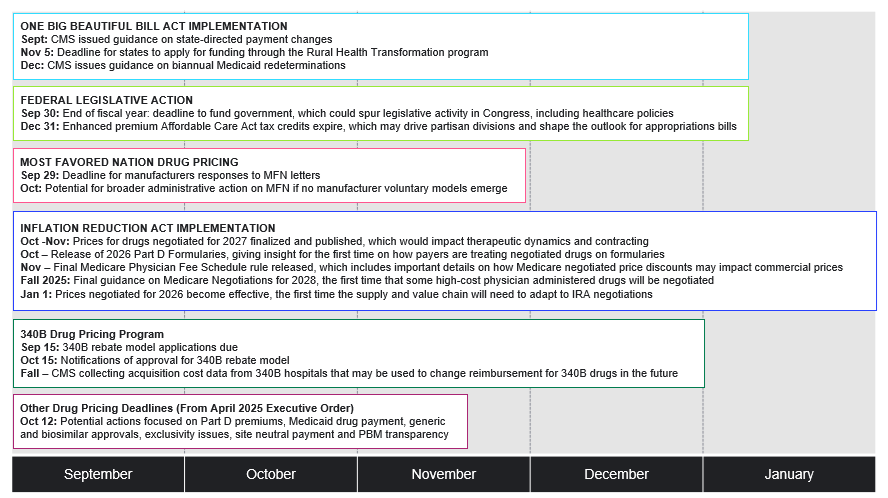

The health policy environment is now approaching an inflection point, with several initiatives converging with annual regulatory activity to produce concrete policy action (see Figure 1). Stakeholders have the need and the opportunity to evaluate potential impact and shape effective advocacy strategies.

Figure 1. Key Health Policy Actions to Watch for the Rest of 2025

Inflation Reduction Act Implementation and Part D

In late September, the Centers for Medicare and Medicaid Services (CMS) released the Medicare Advantage (MA) and Part D Landscape files containing information about plan offerings, premiums, and benefit designs. In October, CMS is expected to release the 2026 Part D Formulary files, which will give insight for the first time on how payers are adapting their formularies for products and therapeutic classes affected by negotiated Maximum Fair Prices (MFPs).

Previously released information on plan bids for 2026 suggests that plans continue to anticipate increased costs. This could be due to increased utilization of drugs in the catastrophic phase of the Part D benefit as well as reductions in total manufacturer rebates that are generally passed through to plans. Considering that the administration is continuing a more limited voluntary Part D Premium Stabilization Demonstration in 2026, stakeholders may also be interested in tracking access implications based on how the number of plan choices, the share of enhanced Part D plans, and the number of plans with $0 deductibles change for next year.

Additionally, this fall, CMS will finalize and publish prices for the second cohort of drugs selected for negotiation, effective in 2027. The announcement will offer insight into the Trump administration’s approach to negotiation and have implications for therapeutic dynamics and contracting in years ahead. CMS will also publish final guidance on Medicare negotiations for Initial Price Applicability Year 2028, which will shape the methodology and process for the next 15 products, including physician administered drugs. The final CY 2026 Medicare Physician Fee Schedule rule will also be released, which may offer insight on how Medicare negotiated prices could impact the commercial market by altering average sales price.

340B Drug Pricing Program

On October 15, CMS will formally announce approval of applications for the voluntary 340B rebate model intended to reduce duplicate discounts on MFP products. The voluntary 340B rebate model will be implemented beginning in 2026, coinciding with the effectuation of MFPs for the first cohort of drugs negotiated by Medicare. In parallel, CMS is also collecting acquisition cost data from 340B hospitals that may be used to change reimbursement for 340B drugs in the future.

One Big Beautiful Bill Act (OBBBA) Implementation

On July 4, President Trump signed the One Big Beautiful Bill Act into law. The law impacts Medicaid eligibility and financing, as well as which drugs are selected by CMS for negotiation in upcoming years. The expanded orphan drug exclusion could potentially affect how manufacturers will consider development and commercialization strategies for orphan drugs in their pipeline. In September, CMS issued guidance on Medicaid state directed payment changes and a Notice of Funding Opportunity for the Rural Health Transformation program created by OBBBA. Looking ahead, CMS is expected to issue guidance in December on biannual Medicaid redeterminations pursuant to OBBBA. The phased-in implementation of OBBBA is expected to influence enrollment across insurance markets and prompt states facing financial pressures to reconsider Medicaid benefits, including potentially the drug benefit.

Stakeholders can expect the developments above to arrive on a relatively predictable schedule. At the same time, there are several possible developments that are more unknown and that could interact to significantly impact drug delivery and pricing across insurance markets:

Drug Pricing Executive Order and Agency Recommendations

In April, the Trump administration issued an Executive Order directing agencies to study several policies, including Part D premium reduction, Medicaid drug payment, generic and biosimilar approval, anti-competitive behavior related to generic and biosimilar market entry, hospital drug acquisition costs, site neutral payment, and PBM transparency. The deadline for agencies to respond to directed action with their findings and recommendations is October 12; these recommendations could guide future policymaking.

As the deadline for policy recommendations approaches, there are reports that the PBM industry is drafting its own set of recommendations for CMS, including proposals aimed at “ensuring patients do not pay more than the cash price charged to uninsured customers, increasing the use of lower-cost alternatives to expensive biologic drugs, and increasing reimbursement rates for rural and independent pharmacies.”

Administrative Action Related to Most-Favored Nation

On July 31, President Trump sent letters to several pharmaceutical manufacturers urging them to extend Most-Favored Nation (MFN) pricing to Medicaid and to create direct-to-consumer models for a set of MFN-priced drugs, among other actions. President Trump requested manufacturer responses by September 29, and there is potential for broader administrative action on MFN if the administration does not see voluntary action it deems sufficient. On September 25, the Office of Management and Budget posted a proposed rule under review titled “Global Benchmark for Efficient Drug Pricing (GLOBE) Model,” potentially signaling its release following the September 29 date.

Additional Legislative Action

Federal funding expires on September 30, which will require Congress to pass appropriations legislation to keep the government fully operating. Congress could pass a continuing resolution (CR) to maintain level funding or full year appropriations bills that modify current funding levels. Either type of appropriations legislation could potentially include additional health-related policies, such as extension of the enhanced advance premium tax credits, PBM reform, Medicare Advantage payment reform, or physician payment reform, among other provisions.

If Congress does not pass appropriations legislation before September 30, at least a partial government shutdown is expected. In the event of a shutdown, health agency staff and capabilities could be seriously diminished. However, because of the nature of funding mechanisms and statutory obligations for key CMS and Innovation Center functions, several of the developments described above are likely to proceed.

Next Steps

This fall, several anticipated policy developments impacting drug pricing and delivery will arrive as significant, yet less predictable, policies could disrupt the broader healthcare environment. Stakeholders will need to think strategically about how these developments could converge to create new policy considerations. Although the drug supply chain is complex, with expertise across various lenses of health plan strategy, Avalere Health is well-positioned to be a valuable thought partner to help your business navigate these changing dynamics and position you favorably in the future. Connect with us to learn more.