CMS Continues to Refine Value-Based Care Approach for Kidney Care

Summary

The kidney care policy landscape is undergoing important changes, given shifts in the Trump administration’s priorities and a reassessment of existing kidney care models.Background

Both the Trump and Biden administrations have advanced policies to address structural inequities in US kidney care. Key initiatives include the July 2025 initiation of the Increasing Organ Transplant Access (IOTA) model and the 2019 Advancing American Kidney Health executive order, which led to the development of the End-Stage Renal Disease (ESRD) Treatment Choices (ETC) model and the Kidney Care Choices (KCC) model options. The second Trump administration has introduced a number of revisions to these Medicare models in 2025, including proposing to sunset ETC model at the end of 2025 and narrowing the available financial models available participating providers.

Kidney Care Choices Model Updates

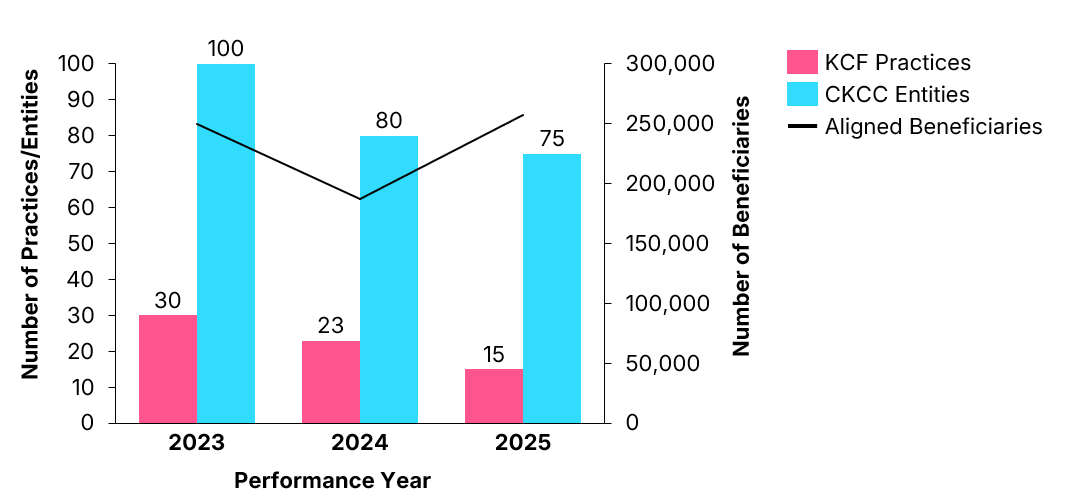

Centers for Medicare and Medicaid Services (CMS) data released in May 2025 highlight significant consolidation within the KCC model participation, marked by provider attrition alongside modest beneficiary growth (see Figure 1). Between Performance Years (PYs) 2023 and 2025, the number of Kidney Care First (KCF) practices decreased from 30 to 15, and the number of Comprehensive Kidney Care Contracting (CKCC) entities declined from 100 to 75. Despite entity attrition, aligned beneficiaries increased from approximately 250,000in PY 2023 to 257,000 in PY 2025, suggesting participants aligned with larger dialysis organizations absorbed contracts from smaller exiting entities. Stakeholders attribute this attrition primarily to increased downside-risk thresholds and intensified documentation requirements. These enrollment trends likely informed CMS’s announcement in late May that it will sunset the KCF track and revise KCC’s financial structure to improve the model’s long-term sustainability.

Figure 1. KCC Provider and Beneficiary Enrollment, 2023–2025

Model Evaluation and Impac

The recent CMS evaluation of the KCC model’s initial performance year (2022) highlights key findings across specific domains:

- Home dialysis and related measures. Home dialysis rose by 20% under KCF and by 32% in CKCC.

- Quality and patient experience in care. The CKCC model increased planned ESRD treatments by 16%, while KCC showed no impact on hospitalizations or medication use for chronic kidney disease (CKD) patients.

- Wait-listing and transplants. KCC did not affect overall transplant rates, but CKCC increased the proportion of patients with an “active” waitlist status by 15%.

- Medicare spending and utilization. The model had no impact on total Medicare Part A and B payments, net Medicare savings or losses, or Part D drug costs per patient per month.

Avalere Health conducted further analyses to understand drug utilization under these models. A 2023 claims analysis conducted for a relevant biologic demonstrated that even under an extreme uptake scenario, this drug would account for less than 0.8% of the total cost of care, translating to less than $150 per beneficiary per month. This finding illustrates that targeted specialty medications can fit comfortably within global budgets under KCC.

Similarly, another 2022 Avalere Health analysis revealed that transitioning 405 dialysis patients to a targeted therapeutic substantially reduced annual inpatient costs by approximately $3,650 per patient, with only a modest increase in dialysis expenditures (approximately $586 annually per patient). This generated net monthly savings of approximately $63 per beneficiary, underscoring how targeted therapeutic interventions can support cost neutrality or even generate savings within value-based arrangements.

Looking Ahead

Historically fragmented kidney care prompted CMS to introduce the ETC and KCC models to improve quality and reduce spending for late-stage CKD and ESRD patients. This landscape also prompted the agency to introduce the IOTA model to evolve incentives within the organ transplantation space. While ETC is set to sunset in 2025 due to its complexity and failure to achieve targeted cost savings and outcomes, the voluntary KCC model remains essential to CMS’s efforts and has been extended through the end of 2027.

Recent KCC updates—including the early termination of KCF, elimination of transplant bonuses, and reductions in CKD quarterly capitation payments—reflect significant shifts aimed at improving the model’s sustainability and cost-effectiveness. These changes are informed by earlier enrollment trends and financial performance and will shape the model’s future trajectory as CMS continues to advance the Make America Health Again initiative and streamlined, multi-condition demonstrations such as IOTA.. The value-based case environment for kidney care is further complicated by the increased enrollment in Medicare Advantage plans by patients with CKD and ESRD.

Avalere Health will continue monitoring these developments, leveraging our extensive expertise across policy, analytics, and market access to guide stakeholders navigating this evolving landscape. To learn more about how Avalere Health can help your business drive access and continuity of care in this dynamic time, connect with us.

Methodology

Referenced Avalere Health analyses were performed using 100% Medicare fee-for-service (FFS) claims, accessed by Avalere Health via a research collaboration with Inovalon, Inc., and governed by a research-focused CMS data use agreement. This includes the 100% sample of Medicare Part A and Part B Medicare FFS claims data.