Stakeholder Considerations for MFP Effectuation in Part B

Summary

Several pathways exist to effectuate the MFP for Part B negotiation with benefits and drawbacks for stakeholders across the drug supply chain.Background

Under the Medicare Drug Price Negotiation Program, the Centers for Medicare & Medicaid Services (CMS) negotiates a maximum fair price (MFP) for a set number of drugs each year. To date, 10 Part D drugs have been negotiated for the Initial Price Applicability Year (IPAY) 2026 and 15 additional Part D drugs are currently being negotiated for IPAY 2027. Beginning in IPAY 2028, Part B drugs will also be eligible for selection.

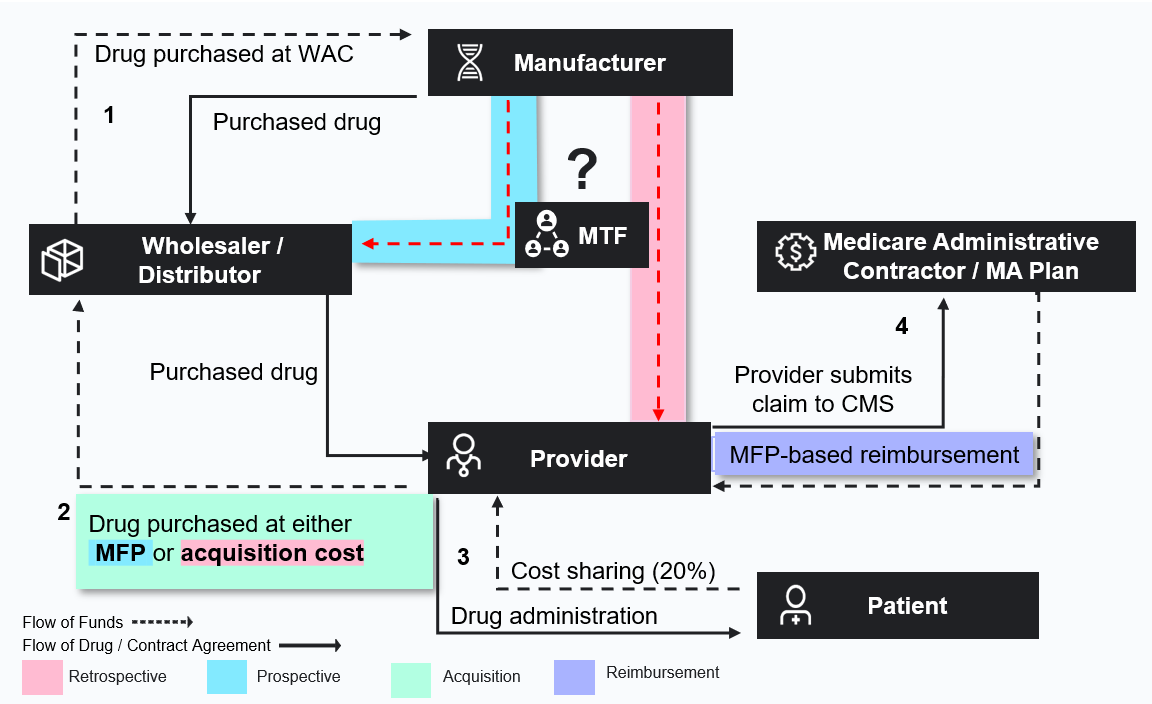

After CMS negotiates MFPs, manufacturers must provide access to the MFP to Medicare beneficiaries and to pharmacies and providers dispensing negotiated drugs. CMS is working with external contractors, collectively known as the Medicare Transaction Facilitator (MTF) to help effectuate access to the MFP.

In October 2024, CMS provided guidance on how manufacturers could effectuate Part D MFPs prospectively or retrospectively, but the agency did not set a standard method. In a prospective model, an inventory of drugs would be acquired at a price at or close to the MFP, likely necessitating the need to maintain an MFP-based inventory separate from drugs to be reimbursed at other prices. In a retrospective model, pharmacies could acquire all drug inventory at a contracted price and receive a reconciliation payment from manufacturers for verified Medicare doses.

Stakeholders are weighing the administrative and financial burdens of the MFP effectuation options proposed by CMS and increasingly looking ahead to understand how CMS may choose to approach the process in Part B. Under Part B, reimbursement for negotiated drugs will shift from the current 106% of average sales price (ASP) to the lower 106% of MFP, increasing financial pressure for providers.

Potential Pathways to Effectuate MFP in Part B

CMS is poised to release the draft negotiation guidance for IPAY 2028 in the coming weeks, potentially outlining initial parameters for Part B effectuation. The potential pathways for operationalizing the MFPs for physician-administered drugs will differ from Part D drugs and may impact buy-and-bill dynamics, contracting and distribution strategies, prescribing incentives, and site of care for negotiated drugs, especially in key affected therapeutic areas like oncology and immunology.

For Part B drugs, distributors acquire drugs from the manufacturers at wholesale acquisition cost (WAC) prices. The manufacturers often have contract prices with providers through group purchasing organization contracts, which enable the providers to acquire the drugs from the distributors at these lower contracted prices. The distributor then sends a chargeback to the manufacturer for the difference between WAC and the contract price so that they are kept whole.

If CMS allows both retrospective and prospective options in Part B, these pathways could involve using the existing chargeback model, the MTF, or both (Figure 1).

Figure 1. Potential Effectuation Pathways

Each model has variable considerations across stakeholder types.

Each model has variable considerations across stakeholder types.

A prospective model could build on the existing chargeback model and add a new contract price that is based on MFP, so payment reconciliation could be handled between manufacturers and wholesalers. A key challenge in this model would be to ensure that products purchased at MFP are only administered to Medicare patients. If and how the MTF bridges the data gap to verify eligibility will impact feasibility.

In a retrospective model, the provider would purchase a negotiated Part B drug at a contracted price (which varies by provider and drug), file a claim, and receive a reconciliation payment from manufacturers for any difference between Medicare reimbursement and acquisition cost. A challenge in this model is how manufacturers will calculate the refund amount owed to the provider, how payment should be handled, how providers will be affected by the time lag in recouping their full acquisition price, and whether the refund will be sufficient to cover their costs.

While in Part D, MFP effectuation in Medicare Advantage (MA) and fee-for-service (FFS) Medicare would rely on the same real-time Prescription Drug Events (PDE) data; for Part B drugs, the flows of data and payment differ between MA and FFS. This adds significant uncertainties and potential new administrative challenges.

Finally, how Part B MFPs are effectuated in the market will likely impact ASP calculations, as well as contracting and reimbursement outside of Medicare. Under MA, verifying and excluding 340B volume could also be more complex, raising the risk of duplicate discounts.

Looking Forward

As CMS prepares to release the IPAY 2028 guidance and Congress continues to focus on physician payment reform, there will be opportunities for stakeholders such as provider groups, manufacturers, payers, and patients to provide insight to help shape the process. A recent Executive Order on drug pricing directs CMS to propose and seek comments on negotiation guidance for IPAY 2028 by mid-June 2025. At the same time, some members of Congress have floated a proposal to reset reimbursement for Part B negotiated drugs back to 106% ASP and handle the MFP discounts directly between manufacturers and the government.

Previous Avalere Health analyses have assessed the impact of MFP on provider reimbursement and potential spillover effects that can shed light on some unintended consequences of Part B negotiations.

Connect with us to learn more about how Avalere Health supports client’s policy, access, pricing, contracting and channel strategy related to Part B negotiations.