CMS Proposes Pay Bump for CAR-T in FY 2026

Summary

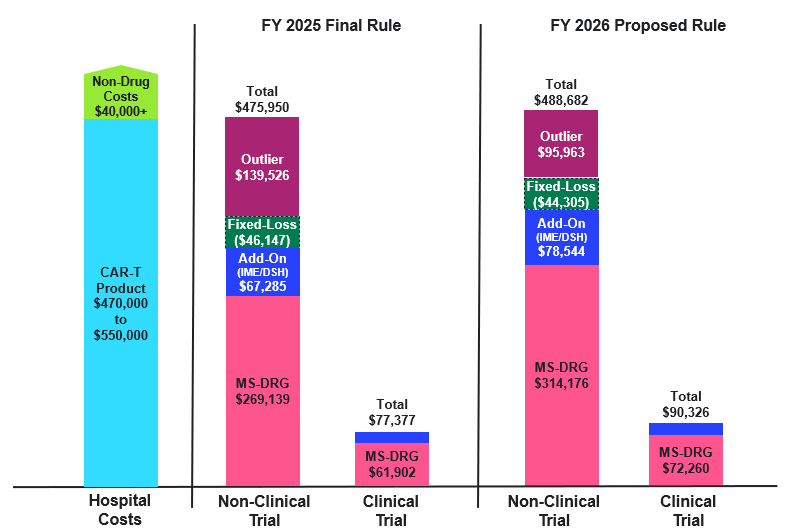

The inpatient rule proposes a 17% increase for CAR-T stays and several CGTs are under review for New Technology Add-on Payments.The Centers for Medicare & Medicaid Services (CMS) proposed to continue using its Medicare Severity Diagnosis-Related Group (MS-DRG) for chimeric antigen receptor T-cell (CAR-T) treatment stays in fiscal year (FY) 2026, but with a 17% increase in the base rate. CMS also proposed to continue providing differential reimbursement based on whether a drug was provided as part of a clinical trial, with a parallel increase proposed. The financial impact of changes in the FY 2026 Inpatient Prospective Payment System (IPPS) proposed rule would vary by hospital, and even if the payment increase is finalized, reimbursement could continue to fall short of fully recognizing provider costs of treatment in some cases.

Background

Since the first Food & Drug Administration (FDA) approval of a CAR-T product in 2017, concerns have persisted over how the Medicare program would reimburse for these products, which are commonly administered in the inpatient setting and have a significant cost for providers (e.g., average sales prices exceeding $450,000). Hospital inpatient reimbursement is calculated on a case-by-case basis using an MS-DRG base payment rate that is adjusted for factors such as hospital geography, diagnosis, case severity, and discharge status. Additional reimbursement can be provided through new technology add-on payments (NTAPs) and outlier payments.

For FY 2025, inpatient stays with CAR-T treatment are currently assigned to MS-DRG 018, which has a base reimbursement rate of $269,139. Outlier payments are available to hospitals to cover extremely costly cases when the costs exceed the total of the MS-DRG payment, the NTAP amount (if applicable), and the current fixed-loss threshold of $46,147. Even with these adjustments, Medicare reimbursement for CAR-T cases today sometimes fails to cover total hospital costs, which can negatively impact provider uptake and patient access.

For FY 2026, CMS proposed several policies that would impact provider reimbursement for CAR-T and other cell and gene therapies (CGTs).

Payment Changes for CAR-T Cases

As a result of an increase to the base operating and capital rates for all IPPS payments and an increase in the proposed relative weight for MS-DRG 018, the proposed base payment for CAR-T cases in FY 2025 would increase by 16.7%, to $314,176.

High-Cost Outlier Payments

The proposed fixed-loss threshold for FY 2026 is $44,305, a 4% decrease over the current threshold. A decrease in the threshold goes against the prevailing trends of steady increases; the outlier threshold increased by 74% from FY 2020 to FY 2025. For CAR-T cases, which are more likely than other inpatient stays to qualify for outlier payments, fluctuations in the threshold are particularly important, as they dictate the losses hospitals must incur before qualifying for an outlier payment. The combination of an increased base rate for CAR-T cases and a lower outlier threshold would increase provider reimbursement (see Figure 1).

Figure 1. Illustrative Example: Hospital Reimbursement for CAR-T Cases Under IPPS: Proposed FY 2026 vs. Final FY 2025

DSH: Disproportionate Share Hospital; IME: Indirect Medical Education

Assumptions:

- Hospital charges for CAR-T episodes are kept constant across all examples, consistent with the geometric mean charges included in the FY 2026 Proposed Rule after outliers removed file ($1,856,594)

- Hypothetical hospital is assumed to have an average operating and capital cost-to-charge ratio of 0.3, which influences CMS calculations of hospital costs.

- Hospital receives add-on payments that stem from payments for IME and DSH adjustments, which are calculated as a percentage of the base MS-DRG. In this figure, there is an assumed IME factor of 0.2 and DSH adjustment of 0.05

- Hospital area wage index is 1.0, meaning no adjustment is made to the labor-related share of the standardized amount.

- Outlier payments cover 80% of the difference in costs and payments after accounting for the fixed-loss amount.

Adjustment for Clinical Trial Cases

CMS reimburses CAR-T clinical trial cases, which do not incur drug costs, at a lower rate than non-clinical trial cases. Using its standard approach with a minor adjustment to exclude cases that do not incur CAR-T drug costs, CMS proposed an adjustment factor of 0.23 to the relative weight of MS-DRG 018 for these cases (the same factor utilized in FY 2025). This would result in a base rate for clinical trial cases of $72,260, an increase of 17% over FY 2025.

Product NTAP Assessments

CMS is evaluating several CGT products for potential NTAP status in FY 2026:

- Obe-cel (AUCATZYL®) for the treatment of acute lymphoblastic leukemia (ALL)

- Liso-cel (BREYANZI®) chronic lymphocytic leukemia or small lymphocytic lymphoma (CLL/SLL). The product was previously approved for NTAP in FY 2021-2022 for large B-cell lymphoma

- Afamitresgene autoleucel (TECELRA®) for the treatment of advanced synovial sarcoma

Key Considerations

Stakeholders should consider several implications stemming from proposed FY 2026 changes for existing assets and for future cell and gene therapies.

- Development of MS-DRG 018:Total reimbursement will vary by hospital and case, but the proposed increase in reimbursement for FY 2026 would support cost recovery for providers. However, profitability by case will become increasingly variable given the assignment of additional therapies to the MS-DRG. There were 1,110 cases available in the data this year to support rate-setting, representing a range of products. Additional immunotherapies mapped to the MS-DRG can lead to fluctuations in the base rate and could eventually lead CMS to consider splitting the MS-DRG depending on the number of cases and differences in resource costs. In the proposed rule, CMS noted a request from commenters to explain why certain cell therapies do not map to MS-DRG 018 and a requestor raised a question about how the cost of a therapy may influence MS-DRG assignment. CMS did not directly address these concerns but did acknowledge that “there may be distinctions to account for as we continue to gain more experience in the use of these therapies.”

- NTAP Eligibility:The increase in the number of available CAR-T products may make it increasingly difficult for new products to qualify for NTAP as it becomes harder to clearly satisfy criteria for newness, cost, and clinical improvement relative to on-market products. Additionally, the consideration of Breyanzi’s NTAP application for a new indication could be informative for other CAR-T manufacturers studying use in new indications.

- Gene Therapy Payment Considerations: In the proposed rule, a requestor suggested the creation of a neurosurgical gene therapy MS-DRG given the approval of KEBILIDITM (eladocagene exuparvovec-tneq) and the number of relevant products in pipeline. Ultimately, CMS stated that given the lack of available data in the claims for these products, it would be premature to establish a new MS-DRG. However, this is a topic that could be revisited as more patients are dosed and could be important given the current assignment of gene therapies to MS-DRGs with base rates dramatically lower than therapy costs.

- Site-of-Care Shifts: Differences in Medicare reimbursement methodology for the inpatient versus outpatient setting can sometimes result in higher reimbursement for CAR-T in the outpatient setting, where CAR-Ts are typically separately paid at average sales price plus 6%. However, the majority of Medicare patients still tend to be treated in the inpatient setting. In an analysis of FY 2023 Medicare fee-for-service CAR-T cases, Avalere Health found that only 10% of cases were treated outpatient. This is fairly consistent in Medicare Advantage as well, where 13% of CAR-T cases took place in the outpatient setting during calendar year 2022. Additionally, the Center for Medicare & Medicaid Innovation could consider alternative reimbursement approaches in Medicare fee-for-service for CGTs, such as bundled payments or site-neutral payment. However, no Medicare models have been announced to date.

Next Steps

Carefully monitoring reimbursement for these innovative products will allow CGT manufacturers, providers, and payers to engage other stakeholders based on anticipated developments. To discuss how Avalere Health can support your business on issues related to CGT commercialization, NTAP proposal submissions, provider reimbursement, access support, or policy developments, connect with us.

Note: Medicare outpatient CAR-T utilization was determined using claims data accessed in the Virtual Research Data Center via a data use agreement with CMS.