CMS Announces the Third Round of Medicare Drug Price Negotiation

Summary

CMS announced the 15 drugs in Medicare Part B and D selected for negotiation for Initial Price Applicability Year 2028.On January 27, the Centers for Medicare & Medicaid Services (CMS) published the list of drugs selected for the Medicare Drug Price Negotiation Program (MDPNP) for Initial Price Applicability Year (IPAY) 2028. Leveraging data from November 1, 2024, to October 31, 2025, CMS identified the 50 highest spend drugs in Part B and Part D separately, then combined the lists and associated spending to select the 15 drugs to be negotiated. This list follows the 25 drugs previously selected in IPAY 2026 and IPAY 2027.

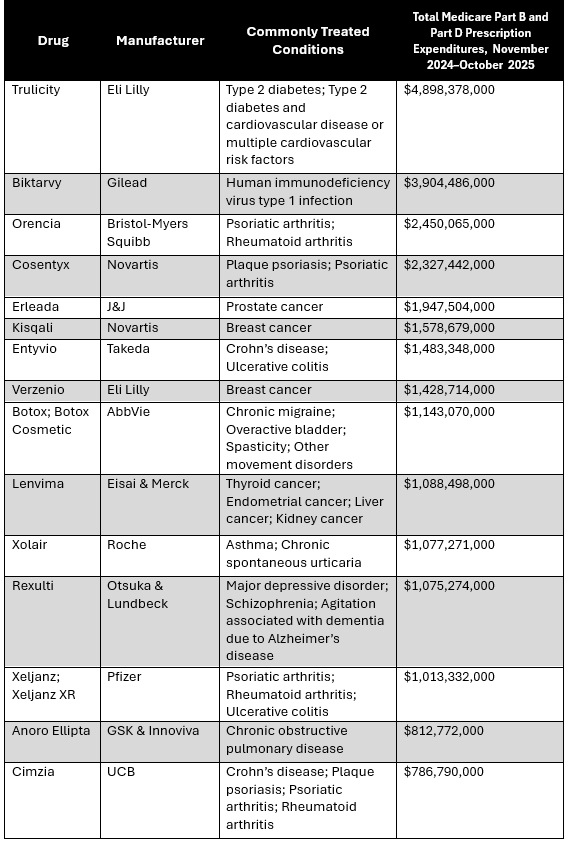

This cohort of drugs (Table 1) spans various therapeutic areas, including oncology, respiratory, cardiometabolic, and immunology diseases. CMS reported that the selected drugs accounted for $27 billion in total Part B and Part D spending (about 6% of total Medicare prescription drug expenditures), providing more detail on the relative footprint of selection drugs than in prior selection cycles.

Primary manufacturers of the 15 selected drugs must now sign an agreement with CMS by February 28, 2026, and then submit data elements required for negotiation by March 1, 2026.

Table 1: Selected Drugs for IPAY 2028

Key Insights

The mix of drugs echoes that of IPAY 2026 and IPAY 2027, with 13 of the 15 IPAY 2028 drugs falling within the same therapeutic classes as drugs with negotiated prices from IPAY 2026 and IPAY 2027. As a result, CMS may classify the previously negotiated drugs as “therapeutic alternatives,” using them as key a key reference point for the maximum fair price (MFP) starting price for IPAY 2028 drugs.

IPAY 2028 is the first negotiation cycle that will include Part B drugs; this year’s selection includes four drugs with primarily Part B volume: Botox, Cimzia, Orencia, and Entyvio. The inclusion of Part B drugs introduces new competitive dynamics between Part B and Part D alternatives, along with important implications for providers. CMS has not yet detailed how MFPs for Part B drugs will be effectuated, raising questions about provider reimbursement risks and operational complexity. Previous Avalere Health analyses examining the impact of MFPs on provider reimbursement and potential commercial market spillover effects detail the unintended consequences of Part B negotiations.

In addition to the 15 drugs for IPAY 2028, CMS has also included one drug, Tradjenta, for renegotiation during the third cycle of negotiations. Selection for renegotiation was likely driven by a change in Tradjenta’s monopoly status.

CMS also noted that several drug companies submitted requests and information for five drugs that were determined to qualify for the small biotech exception. However, the qualified products did not materially impact the 15 drugs selected in IPAY 2028.

Next Steps

As outlined in the CMS final guidance for the third round of negotiations, there will be opportunities for the public to engage with CMS throughout negotiation and renegotiation processes, including patient- and clinical-focused events. Public stakeholders are invited to submit data to CMS by March 1, 2026, on topics such as patient experiences with the conditions or diseases treated by the selected drugs and therapeutic alternatives to the selected drugs.

A Trusted Partner for IRA Negotiations

The Inflation Reduction Act will continue to have wide-reaching impacts across the prescription drug market. As stakeholders start to assess how CMS’s selection of therapeutic alternatives may influence the negotiation process and price-setting, Avalere Health is a trusted partner to develop negotiation strategies and recommendations. For example, our dynamic selection forecast list offers accurate planning for selection risks, a critical tool for driving manufacturer preparation for negotiation selection.

With expertise in policy, evidence strategy, and market access, Avalere Health’s multidisciplinary team can help patient advocates, plans, and manufacturers understand the nuance and complexities of Medicare negotiation for 2028 and beyond. Connect with us to learn more.