3 Ways Manufacturers Can Prepare for New 2023 Discarded Drug Rebate

Summary

As manufacturers prepare for discarded drug rebates to begin in 2023, an Avalere analysis identified 39 drugs at risk for rebates totaling $151 million.Many physician-administered drugs are packaged in single-use vials to protect the product’s safety and efficacy while allowing providers to configure dosing per patient’s weight. However, complex dosing for physician-administered products utilizing single-use vials often leads to unused excess discarded after administration. In 2017, the Centers for Medicare and Medicaid Services (CMS) began requiring all providers to document the amount of drug wastage associated with single-use products using the JW modifier on claims for tracking purposes. While the JW modifier differentiates the discarded product from the quantity administered to patients, Medicare reimburses providers for the entire single-use vial.

In 2018, the CMS began releasing annual data based on tracking the JW modifier that quantifies Medicare Part B discarded drug units and spending. Using the CMS drug pricing dashboard data through 2020, Avalere analyzed the utilization of the JW modifier and physician-administered product waste.

Understanding the quantity and trends in product wastage is especially prudent for manufacturers this year because a provision in the recent Infrastructure, Investment, and Jobs Act (Section 90004) will require manufacturers to pay quarterly refunds to the CMS for the amount of discarded drug. Starting January 1, 2023, manufacturers will be responsible for rebates based on the discarded volume above 10% of the total allowed amount. The quantity of discarded drugs will be determined using the JW modifier in claims.

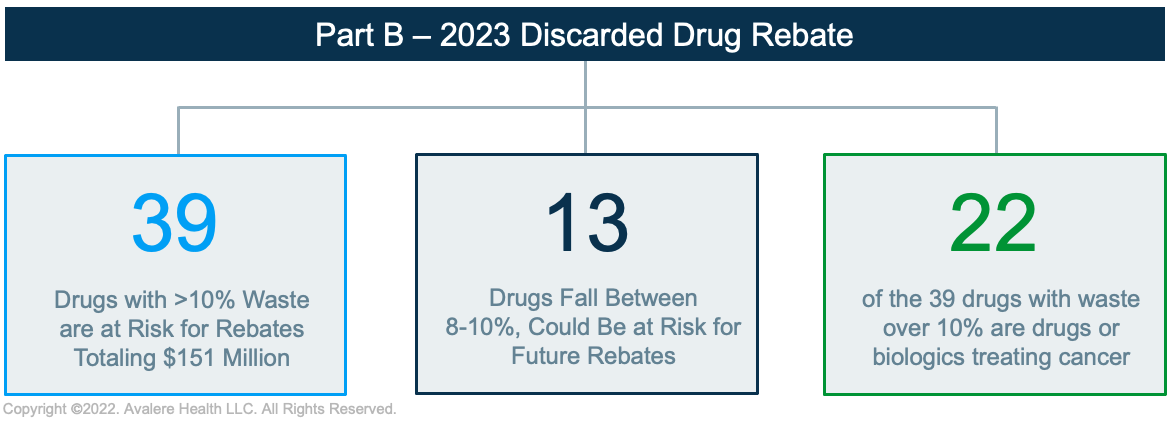

To understand the potential impact of the rebate requirement, Avalere analyzed 2020 data to estimate the number of drugs with waste above the 10% threshold and the approximate rebate amounts if trends stay consistent. In 2020, among all Part B drugs:

If this provision were in place in 2020, manufacturers of the 39 drugs with waste greater than 10% would be liable for $151 million in annual rebates

Manufacturer Considerations

This year, manufacturers of physician-administered, single-use vial drugs may take a 3-pronged approach to evaluate the impact of this provision on their products and identify and implement mitigation strategies if needed.

1. Assessment of Exposure

As manufacturers seek to understand the financial impact of this provision, it will be crucial to accurately quantify the amount of product discarded annually. The data provides insight into the specific therapeutic areas that may bear the most significant burden for wasted drug units. Oncology products, in particular, were most likely to be included in the 39 drugs with waste over the 10% threshold and thus may owe the most significant rebates when this policy is implemented.

Quantifying JW modifier use and wastage will be necessary for manufacturers of on-market products – and manufacturers launching new products. Since this data is only captured for products with permanent J-codes, new physician-administered drugs billed using “Not Otherwise Classified” codes—e.g., miscellaneous J-codes (J3490, J3590, or J999) in the first few quarters of launch—should consider how this policy could affect them once a permanent J code is assigned. Finally, understanding how discarded drug quantities change over time will be vital. Manufacturers of products that fall just under the 10% threshold may become vulnerable to this rebate over time without the employment of mitigation strategies.

2. Evaluation of Mitigation Options and Tradeoffs

After understanding JW modifier use and quantity of waste for their products, manufacturers may need to employ strategies to moderate the impact of these policies. This may be challenging due to changes in dose over time between initial and subsequent doses and dosing variation among patients. However, manufacturers may consider strategies such as aligning vial size more closely with the actual average patient dose via changes in packaging strategy, supplying multiple vial sizes for use, and flat-fixed dosing regimens instead of body-surface area or weight-based dosing. For product formulations with multiple indications, manufacturers should consider the cost and benefits of varying vial sizes by indication and use.

3. Preparation for Rebate Implementation

As manufacturers prepare for the rebate program to begin in 2023, organizations will need to understand this provision as Congress and the administration consider other drug pricing policies. Congress enacted the drug waste rebate as part of the infrastructure package, but the CMS has yet to issue regulations that operationalize the policy and provide more clarity. Additional details are likely forthcoming as part of Medicare payment rules for 2023, which will be released this summer. Stakeholders should also consider how this policy may influence commercial and Medicare Advantage coverage and reimbursement of discarded portions of single-use vial drugs.

Connect with us to stay up to date on legislative and policy changes, access robust claims data, and understand the impact of this provision on your organization.

Avalere Health is an Inovalon company, a leading provider of cloud-based platforms empowering data-driven healthcare. We believe in the power of data, informing actionable insights, delivering meaningful impact, and driving stronger patient outcomes and business economics.