Analysis of Hospital Mergers and Acquisitions and 340B Status

Summary

From 2016 to 2024, buyer hospitals undergoing mergers or acquisitions were more likely to be large (500+ beds) and 340B covered entities.Background

In January 2025, the Centers for Medicare & Medicaid Services (CMS) released an update to the Hospital Change of Ownership (CHOW) dataset, which provides information on hospital ownership changes, including mergers and acquisitions (M&A) from 2016 to 2024. Avalere Health had previously found that buyer hospitals were more likely than the national average to be 340B covered entities. To explore the most recent M&A trends among certain hospitals and understand if trends from its previous analysis have continued, Avalere Health reviewed characteristics of buyer and purchased hospitals as categorized in the latest CHOW dataset, including 340B status, and linked those data to hospital characteristics available in the CMS Provider of Services (POS) data. (Note: The CHOW dataset does not differentiate between acquisitions and mergers and defines the buyer and seller hospitals for each transaction.) Avalere Health’s analysis was limited to transactions that were characterized as an acquisition or merger in the CHOW dataset.

Findings

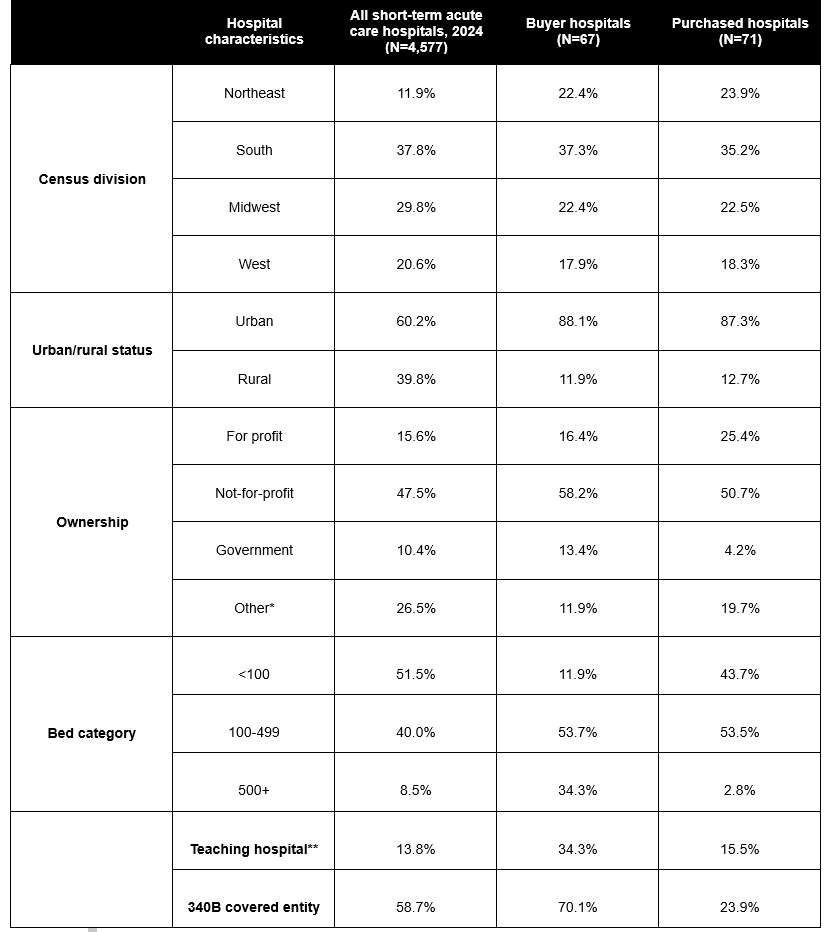

Avalere Health identified 71 unique hospitals that were purchased and 67 unique hospitals that were buyers. One purchased hospital was a critical access hospital; the other purchased hospitals and buyer hospitals were short-term acute-care hospitals (STACHs). Characteristics of buyer and purchased hospitals were compared to STACH hospitals overall (4,577 in 2024).

The characteristics of STACHs that were involved as either buyers or purchasers in mergers or acquisitions are different than the average across all STACHs (Table 1). These results are consistent with Avalere Health’s previous analysis that included data through 2022.

Table 1. Characteristics of Buyer and Purchased Hospitals, Acquisitions in the Hospital Change of Ownership Data, 2016–2024

*This category includes church, hospital district or authority, tribal, physician-owned, and other hospitals as labeled in the CHOW data. **Includes hospitals with major or graduate affiliation with medical schools in the POS data.

Hospitals involved in M&A are more likely to be located in the northeast and in urban areas compared to the national average. Hospitals involved in M&A are also more likely to be not-for-profit than the national average (58.2% of buyers and 50.7% of purchased compared to 47.5% overall).

Some of the characteristics of buyer and purchased hospitals differed from each other and differed from the national average. Buyers are more likely than the national average to be 340B covered entities (70.1% vs. 58.7%), teaching hospitals (34.3% vs. 13.8%), and have a 500+ bed capacity (34.3% vs. 8.5%). Purchased hospitals were less likely than the national average to be 340B covered entities (23.9% vs. 58.7%) and have a 500+ bed capacity (2.8% vs. 8.5%).

Hospital M&A is a driver of consolidation in the US health system, and relative to inpatient hospital care, highly concentrated markets are found in 97% of metropolitan statistical areas according to Federal Trade Commission standards. Research has shown associations between hospital consolidation, increased hospital prices, and higher patient spending. Further, the body of research on consolidation has not shown clear benefits to patients being served in these markets. Understanding the characteristics of hospitals involved in M&A could help policymakers identify drivers of consolidation and mitigate any negative impacts on the health care system. Avalere Health’s analysis shows that 340B covered entities have been purchasing hospitals at a greater rate than average, which raises questions about the dynamics encouraging this behavior. Further research could help policymakers understand what role this safety net program plays in eroding competition in the hospital market.

Methodology

Avalere Health used CMS’s CHOW dataset to identify hospitals undergoing mergers or acquisitions from 2016 to 2024 and examined the buyer and purchased CMS certification numbers, linking them to ownership, bed size, teaching status, urban location, and geography in CMS’s December 2024 POS data. 340B status on the effective date of transaction was identified using the Health Resources and Services Administration’s 340B Office of Pharmacy Affairs Information System.

Funding for this research was provided by the Pharmaceutical Researchers and Manufacturers of America. Avalere Health maintained full editorial control.