Telehealth in Medicare: Shifts Before and After COVID-19

Summary

Pandemic-era telehealth flexibilities in Medicare will expire in April 2025, potentially limiting primary care access for beneficiaries.COVID-19 pandemic accelerated this trend with the rapid adoption of telehealth as a viable alternative to in-person visits. This shift was especially pronounced in primary care, where telehealth emerged as a critical tool for continuity of care during the public health emergency (PHE).

In March 2020, Congress passed the Coronavirus Preparedness and Response Supplemental Appropriations (CARES) Act, which expanded telehealth flexibilities within the Medicare program. Since then, Congress has extended these flexibilities multiple times, most recently through the December 2024 American Relief Act. On March 11, 2025, the House of Representatives passed a continuing resolution, which now sits with the Senate for consideration, that would temporarily extended the following telehealth flexibilities through September 2025:

- Waiving of in-person visit requirement prior to establishing mental health care

- Allowance of non-behavioral/mental health care in the home

To assess how this impending expiration might impact the primary care market, Avalere used Medicare claims data to analyze changes in primary care telehealth utilization by code type and specialty before and after the PHE. The code type analysis explored differences in trends between new and established patient volume, and the specialty-level analysis investigated whether certain primary care specialties—including general practice, family, geriatric, internal medicine, nurse practitioner, pediatrics, physician assistants, and preventive medicine—were more or less likely to adopt telehealth during the PHE.

Primary Care Telehealth Use in Medicare by Code Type and Specialty

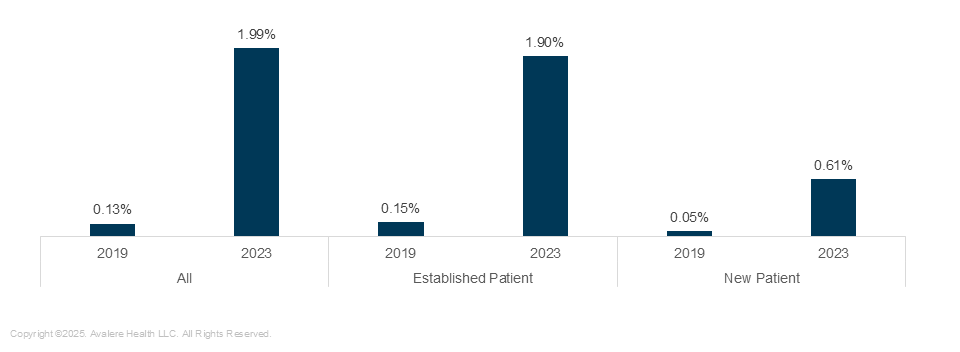

In 2019, telehealth accounted for a minimal portion of Medicare primary care services. Figure 1 shows that only 0.13% of primary care Evaluation and Management (E/M) codes were provided via telehealth, with established patient claims (CPT codes 99212–99215) at 0.15% and new patient E/M codes (99202–99205) at less than 0.1%. The remaining volume was considered in-office (in person).

Figure 1: Telehealth Use in Medicare as a Share of All Primary Care Visits, by E/M Code Type

By 2023, telehealth usage increased significantly, with approximately 2% of all Medicare E/M services occurring in the telehealth setting. Among office visits, established patient visits rose to 1.9%, and new patient visits climbed to 0.6%. While these figures represent nearly a 10x increase across all code types, the majority of E/M primary care services remain concentrated in the office setting.

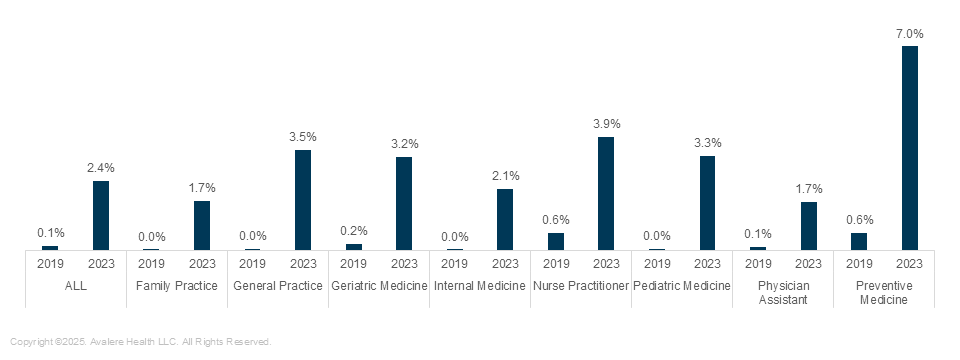

Telehealth adoption has also varied across primary care specialties, as shown in Figure 2. In 2019, telehealth utilization was below 1% across all specialties, with preventive medicine showing the highest adoption at 0.61%, and family practice the lowest at 0.01%.

Figure 2: Telehealth Use in Medicare as a Share of All Primary Care Visits, by Primary Care Specialty

By 2023, the average utilization across all primary care specialties rose to 2.4%. Preventive medicine was most likely to shift to virtual care with, 7.0% of services delivered via telehealth, while family practice was least likely at 1.7%. Unlike in 2019, when no specialty exceeded 1% utilization, all primary care specialties now provide at least 1.5% of care virtually, an increase of over 1.9 million telehealth appointments across primary care, underscoring a subtle yet significant shift in how care is delivered.

When considering the volume of visits represented in this increase (see Table 1), 0.5% of all primary care visits represents 443,694 patient encounters in 2023.

Table 1. Volume of Primary Care Telehealth Visits, by Specialty, 2023

| Primary Care Specialty | Number of Claims | Share of Total |

|---|---|---|

| Internal Medicine | 25,675,296 | 28.9% |

| Family Practice | 25,477,685 | 28.7% |

| Nurse Practitioner | 22,473,319 | 25.3% |

| Physician Assistant | 13,536,561 | 15.3% |

| General Practice | 999,556 | 1.1% |

| Geriatric Medicine | 367,993 | 0.4% |

| Pediatric Medicine | 173,989 | 0.2% |

| Preventive Medicine | 34,413 | 0.04% |

| Total | 88,738,812 | 100% |

What’s Next

While the pandemic served as a catalyst for its adoption, telehealth has become a well-established access option within the care continuum. After a significant spike in telehealth utilization at 43% of primary visits in April 2020, utilization has normalized and in-person visits remain dominant, particularly for new patient evaluations. Despite its persistent utility in improving access for a portion of Medicare beneficiaries, these telehealth flexibilities within the Medicare program remain temporary. Congress continues to pass extensions of these flexibilities, as opposed to legislation that would make the flexibilities permanent. As policymakers and providers continue to refine telehealth strategies, the challenge will be to balance concerns around growing Medicare utilization and costs while maintaining availability for individuals who would not otherwise receive care.

Connect With Us

To learn more about how the state and federal policy landscape impacts site of care decisions made by patients, providers, and payers, connect with us.